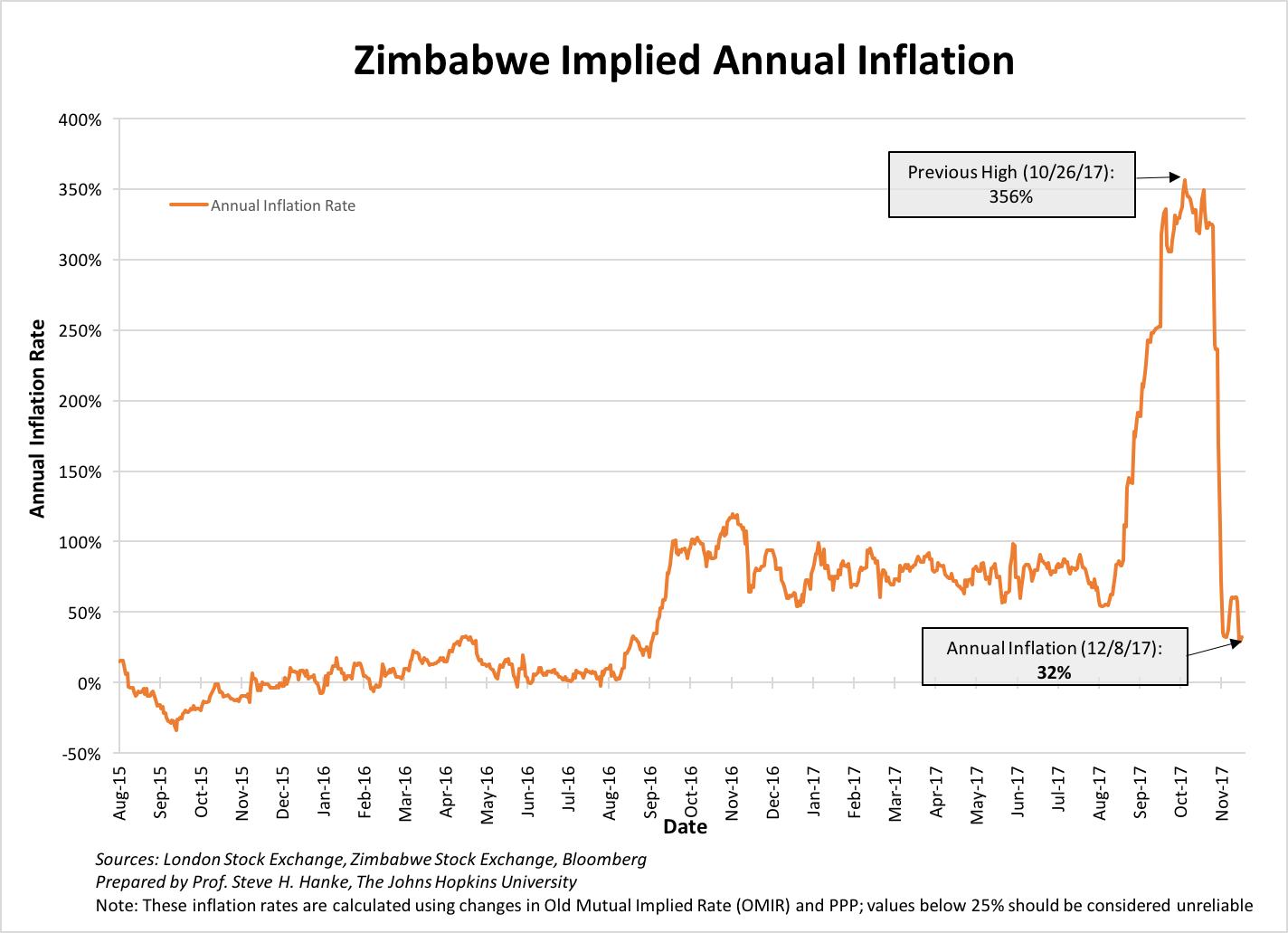

Robert Mugabe’s 27-year reign of lawlessness, corruption, and incompetence came to an end late November 2017, after a “soft coup” engineered by Emmerson Mnangagwa (aka “the Crocodile”) successfully unseated the aged dictator. Since then, inflation expectations in Zimbabwe have fallen sharply. In consequence, inflation has fallen like a stone. Indeed, before Mugabe’s resignation, Zimbabwe’s implied annual inflation soared to peak rate of 356% (10/26/17). But, following Mnangagwa’s assumption of power, the implied annual inflation rate has fallen to today’s rate of 32%.

In 2008, Zimbabwe suffered the second most severe episode of hyperinflation in recorded history. The annual inflation rate peaked in November 2008, reaching 89.7 sextillion (10^23) percent (see table below).

At the peak of Zimbabwe’s hyperinflation episode in November 2008, Zimbabweans refused to use the Zimbabwe dollar. With that, the economy was spontaneously, and unofficially, dollarized. Eventually, the government faced this fait accompli in early 2009, when they dollarized the economy by accepting the dollar as the unit of account for government finances.

This year, Zimbabwe once again experienced a bout of hyperinflation, not due to dollarization, but because the Zimbabwean government is issuing, in effect, a new currency that is circulating parallel to the U.S. dollar. Currently (12/8/17), the annual inflation rate is at 32% (see chart below).

During Zimbabwe’s hyperinflation episode from 2007-2008, the Reserve Bank of Zimbabwe failed to report an accurate measure of inflation rates. When episodes of hyperinflation occur, the only feasible and reliable way to measure the inflation rate is via the application of Purchasing Power Parity (PPP). To do so, data on the exchange rate between the domestic currency and a stable international currency are required. This was not feasible in Zimbabwe. The Zimbabwe dollar was not traded on an organized exchange that reported exchange rates, and the use of black-market exchange rates was not feasible either.

However, the organized stock market in Harare did provide prices that allowed for the calculation of implied Zimbabwe dollar exchange rates. One stock, Old Mutual, was, and still is, listed on both the London Stock Exchange and the Zimbabwe Stock Exchange. Each share of Old Mutual commands the same claim on the company’s earnings and assets, irrespective of the market it is traded on. Therefore, given arbitrage and PPP, the ratio of the Old Mutual share price in Harare to that in London equaled the Zimbabwe dollar/sterling exchange rate.

To convert the resulting Zimbabwe dollar/sterling exchange rate to a Zimbabwe dollar/U.S. dollar rate, I multiplied the Zimbabwe dollar/sterling rate by the sterling/U.S. dollar rate, creating what is known as the Old Mutual Implied Rate (OMIR). By using the OMIR as an exchange rate between Zimbabwe dollars and USD, PPP was then applied as the final link necessary for calculating inflation rates.

When President Robert Mugabe’s party, ZANU-PF, regained control in Zimbabwe in 2013, government spending and public debt surged, resulting in economic instability. To finance its deficits, the government created a “New Zim dollar.” The New Zim dollar is issued at par to the U.S. dollar, but trades at a significant discount to the U.S. dollar. As a result of the issuance of the New Zim dollar, the money supply has exploded in Zimbabwe, and so has inflation.

Employing the same theory and method of measurement that was used to calculate Zimbabwe’s 2007-2008 hyperinflation episode, I was once again able to measure an accurate inflation rate, explained here in a detailed study. After doing so, I found that Zimbabwe experienced hyperinflation for the second time in less than ten years between September 2017 and early November 2017.

Hyperinflation occurs when the monthly inflation rate reaches 50% per month and remains above that rate for at least 30 consecutive days. This initial threshold was breached on September 14, 2017, and the monthly inflation rate stayed above this rate until November 2, 2017. Currently, the monthly rate of inflation is -68%

zerohedge