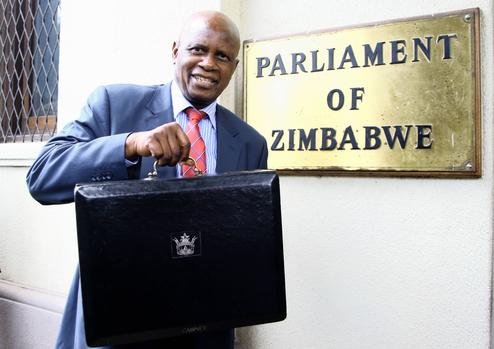

INTERNATIONAL – When Patrick Chinamasa marks the start of his second stint as Zimbabwe’s finance minister by presenting the budget on Thursday, investors will be looking for policy changes in addition to fiscal plans in the post- Robert Mugabe era.

While the government needs to rein in runaway spending, end cash shortages and recapitalize banks, signals that it plans to revise or repeal contentious policies such as forcing companies to transfer 51 percent stakes to black Zimbabweans could be a game-changer. It could lure back investors and smooth engagement with lenders like the International Monetary Fund and the World Bank.

Chinamasa, a lawyer, was reappointed last week by President Emmerson Mnangagwa, less than two months after former leader Mugabe moved him to another portfolio. Mugabe resigned two weeks ago after an army-led coup ended his 37-year rule. During his tenure, agricultural output collapsed due to forced repossessions of commercially productive, mainly white-owned farmland, Zimbabwe abandoned its currency in 2009 due to hyperinflation and the economy has halved in size since 2000.

A half-hearted attempt at solving expropriation, taming inflation and curbing the country’s massive import bills would be a continuation of Mugabe’s “insular budgetary policies,” said Charles Laurie, head of country risk at Bath, England-based Verisk Maplecroft. There will be “intense scrutiny” of Chinamasa’s plans by investors who expect “business-friendly budgetary policy,” though the focus would mostly be on the empowerment law.

“Repealing or gutting the law will be an essential step in signaling to foreign businesses that Zimbabwe is serious about fostering a viable business environment,” Laurie said. “It’s nearly impossible to imagine a revival of Western investor appetite should this politically motivated law remain on the books.”

Leading Efforts

Chinamasa has led efforts to revive the struggling economy and tap fresh credit. While Zimbabwe has paid $110 million of arrears to the IMF, it’s still saddled with $1.7 billion arrears to the World Bank and African Development Bank and external debt exceeds 70 percent of gross domestic product.

In 2000, Mugabe backed violent seizures of about 4,500 mostly white-owned farms to redistribute to black subsistence farmers in a land-reform program that led to the deaths of farmers and farm workers in clashes with people moving onto the land. The move crippled commercial agricultural output, with shipments of tobacco, the biggest foreign-currency earner, only starting to return to 2000 levels last year.

Hyperinflation, estimated by the IMF to have peaked at about 500 billion percent at the end of 2008, forced the nation to abandon its currency in early 2009 in favor of a basket of foreign exchange including the the dollar, the rand, the euro and the pound. The country has now printed what it calls bond notes, which it says have the same value as dollars.

Economic growth may contract in 2018 if no immediate steps are taken to solve protracted liquidity shortages, said BMI Research, a unit of Fitch Group Inc. The government forecasts GDP will expand 3 percent in 2018 from 3.7 percent in 2017.

Reform Program

Zimbabwe holds the world’s biggest platinum reserves after South Africa and also has chrome, gold, iron ore, coal and diamonds. While mining is the largest source of foreign currency, fresh capital dried up under the law forcing foreign, white-owned companies to cede 51 percent of their businesses to black Zimbabweans or the government. Anglo American Platinum Ltd., Impala Platinum Holdings Ltd., and Sinosteel Corp. are among companies operating there.

A “strong and coherent reform program” may result in the economy being reintegrated into the global market, while a financial package may be “possible” if arrears are settled, said Gerry Rice, a spokesman for the IMF. The lender, which is holding talks with the government this month, is ready to help the nation on policies to restore stability and growth. It “will require concerted efforts to tackle the fiscal deficit, and to complement that with structural reforms,” he said.

Mnangagwa, 75, and Chinamasa “pushed back” against some of Mugabe’s initiatives and they may prioritize reviving agriculture and policy changes “in exchange for desperately needed finance”, said Francois Conradie, head of research at Paarl, South African-based NKC African Economics.

Investors can forgive past misdeeds provided the signals for future stability are strong, Verisk Maplecroft’s Laurie said.

“Should Mnangagwa take sound steps to begin restoring investor and diplomatic confidence, it is likely that Zimbabwe will benefit from an influx of foreign working capital,” he said.

– BLOOMBERG